Page last updated on April 3rd, 2024

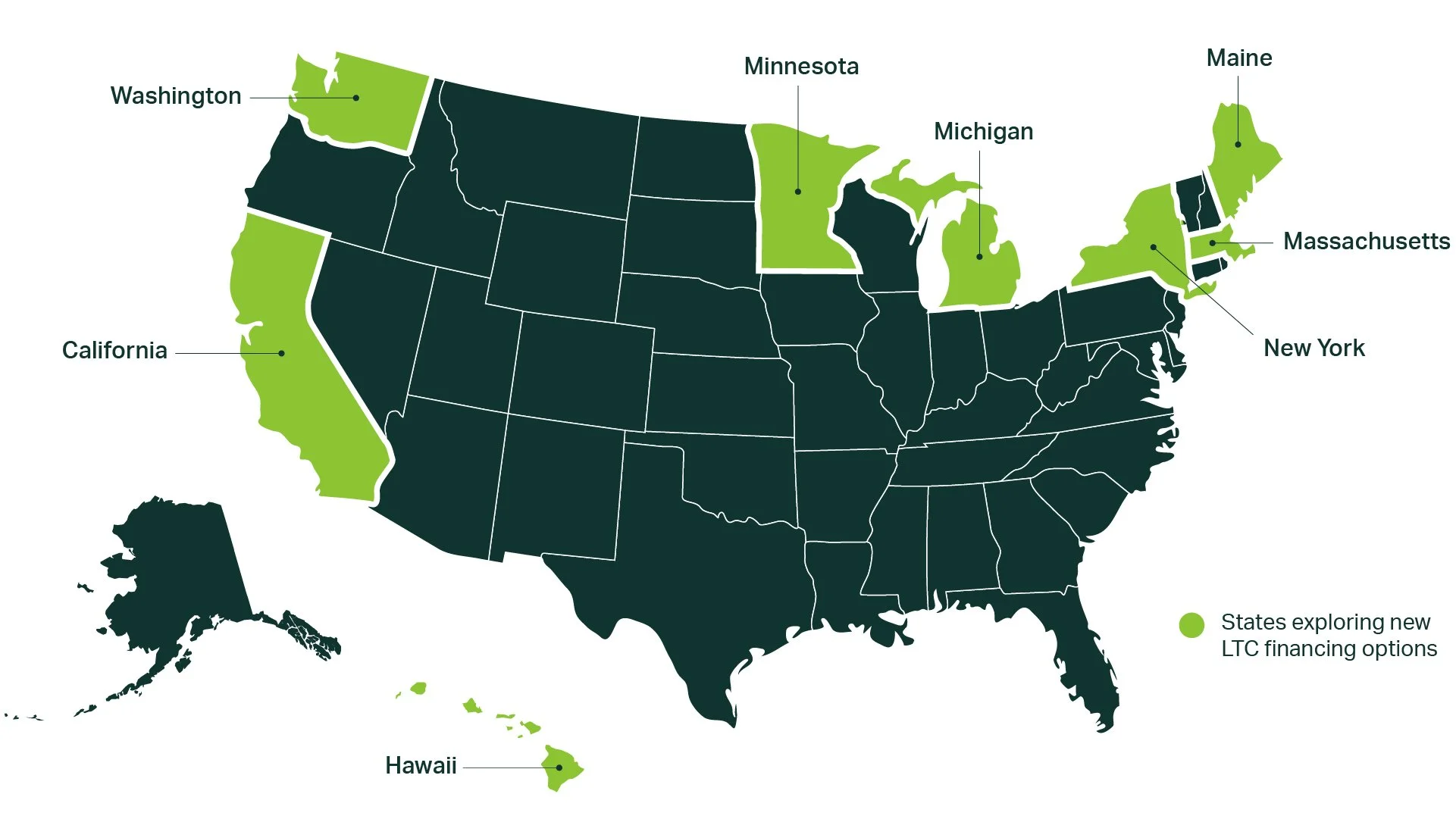

State By State Long-Term Care Progress

Our communities need more equitable and affordable systems to better serve workers, consumers, and family caregivers.

Learn more about on-going efforts to create new programs in these states.

California

Summary:

California released an LTSS social insurance program actuarial study in December 2023. Simultaneously, advocates have successfully expanded access to Medicaid LTC and continue to push for further expansions.

Program Design:

Social insurance; Medicaid expansion

Stage:

Actuarial study completed; Stakeholder engagement

Key Stakeholders:

Throughout these processes, the California Aging and Disability Alliance (CADA) – a coalition including unions, consumer and worker advocates, and providers – has been a driving force in continuing to push the conversation forward.

Get Involved: Care Can’t Wait California

Details:

Previous work to build a new LTC financing program include:

Conducting an initial feasibility study on a state-based LTC financing program in 2020 and a second feasibility study in 2022;

Creating a Master Plan on Aging in 2021, which included a recommendation to build a state-based LTC financing program beyond Medicaid.

In December 2023, the Long-Term Care Insurance Task Force released an actuarial report that assessed five more detailed benefit options for an LTSS social insurance program, after an involved stakeholder engagement process. While there are still areas that need to be figured out (such as workforce investments and financing mechanisms), stakeholders will be able to use this more robust data to determine next steps in establishing a new social insurance program.

Meanwhile, CADA and others in the state have also been exploring how to expand Medicaid in ways that support access to affordable LTC. Successes have included removing the LTC asset limit and expanding access to undocumented immigrants.

Hawai'i

Summary:

In 2003, the Governor vetoed legislation to create a social insurance program. The state eventually created two smaller programs (now merged into a single program) that provide LTC benefits to older adults and to family caregivers who don’t qualify for Medicaid.

Program Design:

Social insurance; public program

Stage:

N/A

Key Stakeholders:

The push for social insurance, and the subsequent push for the Kupuna Caregivers Program, involved a wide variety of stakeholders including advocates, providers, and government.

Details:

Hawai’i has the longest history of exploring LTC social insurance, with efforts dating back to 1985. The Governor vetoed legislation that would have created a long-term care social insurance program. Unsuccessful attempts to pass LTC social insurance legislation in 2012 and 2016 led the state to focus on two public benefit programs for people who don’t qualify for Medicaid, paid for through the state budget.

In 2008, it created the Kupuna Care Program, which offers home- and community-based services to people over the age of 60 with LTC needs. In 2017, it created the Kupuna Caregivers Program that offered home- and community-based services to care recipients of family caregivers who are employed at least 30 hours per week.

These programs are funded through state general funds, meaning they rely on annual budget approvals. Upon discovering that the Kupuna Caregivers Program served the same population as the Kupuna Care Program, the two were merged as of 2022 (pooling the funding that had previously been allocated).

Maine

Summary:

Maine tried to pass a ballot measure to create an LTC social insurance program in 2018, but the ballot measure failed. Since then, conversation around LTC financing has stagnated.

Program Design:

Social insurance; Medicaid expansion

Stage:

N/A

Key Stakeholders:

The ballot initiative was led by the Maine People’s Alliance and supported by the local SEIU affiliate and other advocacy organizations.

Get Involved: Maine People’s Alliance

Details:

The Maine People’s Alliance led a 2018 ballot initiative to create a social insurance program called the Universal Home Care Trust Fund. The program was designed to be financed by higher income individuals and employers (with incomes over about $128k). While there was robust support from union and other advocacy groups, opposition was concerned about the progressive nature of the tax, the limited controls on who could access the benefits, and that oversight would fall outside of the legislature. Ultimately, the ballot measure was voted down (63% to 37%), which has stymied LTC financing discussions in the state since.

Massachusetts

Summary:

In July 2023, the MA state budget funded an actuarial study that will assess the cost of various program design decisions regarding a new LTC financing program in 2024.

Program Design:

Social insurance

Stage:

Actuarial study

Key Stakeholders:

To date, LeadingAge MA, the Massachusetts Senior Action Council, and Marc Cohen, Professor in the Gerontology Department at UMass Boston and Co-Director of the LeadingAge LTSS Center @UMass Boston have been driving forces in moving this forward, along with legislative champions Massachusetts State Senator Patricia Jehlen and Representative Thomas Stanley.

Details:

Efforts in MA date back to 2010, when its Long-Term Care Financing Advisory Committee made recommendations around implementing the federal LTC social insurance program in the Affordable Care Act (the CLASS Act, which was later repealed). Building off the broad realization during the pandemic that the structure of the long-term care system is unsustainable, the Blue Cross Blue Shield of Massachusetts Foundation released a report on five key priorities for the next administration – one of which was LTC financing. This helped to build momentum for LeadingAge to work with legislative champion Senator Jehlen to fund an actuarial study through the 2023-2024 state budget. The results of the study will be used as a starting point for broader stakeholder conversations about what a new LTC social insurance program could look like in MA.

A related bill, H. 652, was introduced by legislative champion Representative Stanley that would create a taskforce to make recommendations on the structure of a LTC social insurance program and conduct an actuarial study including those specific recommendations, but it has not yet passed.

Michigan

Summary:

The state conducted a feasibility and actuarial study of private insurance and a social insurance option but stakeholders have not yet coalesced around an LTC financing program proposal. To build a better home care workforce infrastructure for both Medicaid and a future LTC financing program, advocates and SEIU successfully passed legislation to restore home care workers’ right to form a union and create a state authority to help with self-directed care.

Program Design:

Social insurance; private insurance

Stage:

Stakeholder engagement

Key Stakeholders:

The Michigan Caring Majority (now Care Can’t Wait Michigan) and the Care Caucus played key roles in getting the feasibility study funded. Care Can’t Wait Michigan and SEIU are playing key roles in advocating for the new workforce legislation.

Get Involved: Care Can’t Wait Michigan

Details:

Due to years of stakeholder engagement and coalition-building, the Michigan legislature passed a bill requiring a feasibility study on LTC reform and workforce investment strategies in 2018.

This study, released in 2021 and paid for through a combination of government and philanthropic funds, included actuarial estimates of an LTC social insurance program and a public-private partnership focused on private long-term care insurance. However, due to the pandemic and competing priorities, stakeholders have not yet coalesced around an LTC financing program proposal.

To lay the groundwork for any future program, Care Can’t Wait Michigan and SEIU partnered with other advocates in the state to create higher quality home care jobs in the state. To accomplish this, they successfully advocated for legislation to restore home care workers’ right to unionize, which had been removed in 2012. The legislation will also create a home care authority that can set clearer standards for workers in the Medicaid consumer directed program.

Minnesota

Summary:

The state conducted an actuarial study evaluating new models for private LTC insurance and is now in the process of deciding the best path forward in partnership with a stakeholder advisory group.

Program Design:

Private insurance; social insurance

Stage:

Actuarial study completed; stakeholder engagement

Key Stakeholders:

The conversation around LTC financing has been driven by the Own Your Future initiative, which has been led by the MN Department of Human Services and has incorporated a variety of stakeholders.

Get Involved: The Own Your Future Initiative

Details:

Through an initiative called Own Your Future, Minnesota has undergone a multi-stage process to identify the best ways to finance LTC in its state. It began with creating new private insurance offerings to better meet the needs of middle-income individuals, including a private life insurance that converts to LTC insurance after age 65 (called LifeStage).

Realizing that the private market is insufficient to address the needs of middle-income individuals, the latest stage of Own Your Future released a report and actuarial study in November 2023 offering three options that could be implemented in combination or individually:

LTC navigation and support services – Provided virtually, telephonically, and in-person, these services would help people understand their LTC options and support them in navigating the system.

Medicare Companion Product – This product would partner Medicare coverage with a private or public insurance option that would coordinate acute care and LTC.

LTSS Social Insurance – Referred to as the “Catastrophic Lite Benefit,” this social insurance program would provide up to five years of benefits after a two-year waiting period. It would be paid for through a payroll tax and/or through a monthly premium.

The MN Department of Human Services is in the process of convening stakeholders and determining whether and how it will move forward with the recommendations laid out in the report. To support this decision-making process, the state also funded studies on current and future Medicaid LTC utilization and on the demographics of older Minnesotans.

New York

Summary:

New York is in the early stages of discussing LTC social insurance. In the past, it explored private insurance solutions and building a single-payer system. It has also expanded Medicaid LTC access for people with disabilities.

Program Design:

Social insurance; private insurance; Medicaid expansion

Stage:

Stakeholder engagement

Key Stakeholders:

The NY Health Act was long championed by Assembly Member Richard Gottfried. The Campaign for NY Health has been a key advocate, working in partnership with many advocates and legislators. Conversations around social insurance are still nascent but early drivers have included Senator Shelley Mayer, the NYS Association of Health Care Providers, and Allison Cook of Better Aging and Policy Consulting. The expansion of the Medicaid Buy-In program was led by the NY Association on Independent Living and Consumer Directed Action of NYS.

Get Involved: New York Caring Majority

Details:

New York has explored several alternative programs for LTC. The Partnership Plan, a private LTC insurance offering that would allow people to keep more assets if they later needed Medicaid, stopped accepting new enrollees in 2021. In the past decade, advocates have galvanized around a single-payer health coverage bill, the NY Health Act, which would include LTC coverage.

With this effort currently stalled, the NY Master Plan for Aging has offered a new opportunity to explore alternatives. Recent efforts have centered on exploring social insurance. A preliminary report for its Master Plan for Aging, included a recommendation to “develop a plan to support the long-term care needs of individuals who do not qualify for Medicaid.” Workgroups are actively driving discussion around conducting an actuarial study focused on social insurance. Further, Senator Shelley Mayer introduced a bill (S8462) modeled off the WA Cares Fund but it has yet to gain traction.

Additionally, due to the advocacy of disability rights organizations, the state will significantly expand eligibility for its Medicaid Buy-In for Working People with Disabilities in 2025, enabling them to better access the LTC supports that enable them to work.

Washington State

Summary:

Washington state created the first LTC social insurance program in the nation, called the WA Cares Fund. The program started collecting payroll taxes in July 2023 and benefits will begin in 2026. An unsuccessful November 2024 ballot initiative sought to undermine the program by making it optional.

Program Design:

Social insurance

Stage:

Implementation

Key Stakeholders:

From the start, Washingtonians for a Responsible Future – now We Care for WA Cares – has played a key role in driving the conversation forward, conducting public outreach and education, and bringing in a variety of stakeholders to the process.

Get Involved: We Care for WA Cares

Details:

Washington is leading the way in building a state-based LTC financing program. Passing the Long-Term Services and Supports Trust Act (which later became the WA Cares Fund) required stakeholder engagement, coalition-building, amending legislation, and working closely with legislative champions. The program will provide up to $36,000 in lifetime benefits to three groups: 1) those who have paid in for at least 10 years; 2) those who have paid in for at least three of the last six years and have a sudden LTSS need; and 3) those who were born before 1968 and have contributed for at least one year (at a partial benefit rate of 10% for each year contributed).

Since its passage, a few key amendments have been made, including allowing:

Military veterans with 70% or greater service connected disability to opt out;

Workers who live out-of-state to opt out;

Near-retirees to access partial benefits; and

Those who move out-of-state to access benefits.

The program began to collect payroll taxes in July 2023. The state is working closely with stakeholders to get all of the rules and regulations in place prior to 2026, when benefits will begin to be paid out for eligible individuals.

The program faced a November 2024 ballot initiative (Initiative 2124). If passed, enrollment in the WA Cares Fund would have become voluntary, undermining the financial stability of the program. Thankfully, the ballot initiative was unsuccessful and the program remains fully functional.